I am seeing many financial commentators now starting to talk about inflation and therefore interest rate increases, which of course means higher home loan rates.

As they say, “Where there is smoke, there is fire” and so I am asking if your mortgage strategy has measures to protect against a future with higher home loan rates.

Or, like many Kiwis have you just fixed your mortgage at what was considered a good interest rate?

Do You Have A Mortgage Strategy?

One of our roles as advisers is to assist with establishing a mortgage strategy and loan structures to complement that.

It’s easy to randomly select a fixed rate and fix your home loan for some time, and that seems to be what most bankers tend to do with little thought given to your financial situation and/or plans. In many cases, I see where a bank has just lumped the whole loan amount into one fixed term which is unhelpful and appears they have been lazy. There has been little thought given to what will happen when the loan comes off fixed.

A mortgage strategy should be a well-thought-out plan that suits your situation, protects against future higher home loan rates, allows you to pay the home loans off faster, and is flexible enough to let you adapt the repayments for future events.

As advisers, our team at Mortgage Managers will work with you to develop a mortgage strategy and then help monitor and adjust it as required. This is something that I don’t even charge for as the banks often will pay us and I believe that it is part of the service that a mortgage adviser can offer to add value to you.

Planning For Higher Home Loan Rates

Whenever you make a plan you should prepare for the worst, but hope for the best.

Of course, when thinking about your home loan, it can be your biggest financial commitment and therefore it deserves a bit of time to plan what can happen … to develop a strategy and set the loan structure.

I generally suggest that you do your calculations on affordability at higher home loan rates to ensure that you can afford those, and then it’s always a good idea to adopt those repayments to pay the mortgage off faster while rates are low.

Consider this; you get a mortgage for $500,000 and the average home loan rates are about 2.60% and therefore if you fixed the whole loan for 30-years at this average interest rate then your repayments would be about $462 per week. Those repayments seem okay and may even be cheaper than rent. But what happens if higher home loan rates of ‘say’ 5.00% are applied to the same loan? The weekly repayments increase to $619 and that’s an increase of $157 per week.

This might be fine now while things are all going well; however remember that often higher home loan rates come as a result of inflation so you will also have higher living costs to deal with and maybe not higher incomes. It’s something that you should factor in to your mortgage strategy.

I am seeing many financial commentators now starting to talk about inflation and therefore interest rate increases, which of course means higher home loan rates.

As they say, “where there is smoke, there is fire” and so I am asking if your mortgage strategy has measures to protect against a future with higher home loan rates.

Or, like many Kiwis have you just fixed your mortgage at what was considered a good interest rate?

Do You Have A Mortgage Strategy?

One of our roles as advisers is to assist with establishing a mortgage strategy and loan structures to compliment that.

It’s easy to randomly select a fixed rate and fix your home loan for a period of time, and that seems to be what most bankers tend to do with little thought given to your financial situation and/or future plans. In many cases I see where a bank has just lumped the whole loan amount into one fixed term which is unhelpful and appears they have been lazy. There has been little thought given to what will happen when the loan comes off fixed.

A mortgage strategy should be a well thought out plan that suits your situation, protects against the future higher home loan rates, allows you to pay the home loans off faster and is flexible enough to let you adapt the repayments for future events.

As advisers, our team at Mortgage Managers will work with you to develop a mortgage strategy and then help monitor and adjust it as required. This is something that I don’t even charge for as the banks often will pay us and I believe that it is part of the service that a mortgage adviser can offer to add value to you.

Planning For Higher Home Loan Rates

Whenever you make a plan you should prepare for the worst, but hope for the best.

Of course when thinking about your home loan, it can be your biggest financial commitment and therefore it deserves a bit of time to plan what can happen … to develop a strategy and set the loan structure.

I generally suggest that you do your calculations on affordability at higher home loan rates to ensure that you can afford those, and then it’s always a good idea to adopt those repayments to pay the mortgage off faster while rates are low.

Consider this; you get a mortgage for $500,000 and the average home loan rates are about 2.60% and therefore if you fixed the whole loan for 30-years at this average interest rate then your repayments would be about $462 per week. Those repayments seem okay and may even be cheaper than rent. But what happens if higher home loan rates of ‘say’ 5.00% are applied to the same loan? The weekly repayments increase to $619 and that’s an increase of $157 per week.

This might be fine now while things are all going well; however remember that often higher home loan rates come as a result of inflation so you will also have higher living costs to deal with and maybe not higher incomes. It’s something that you should factor in to your mortgage strategy.

So a good idea is to try making the bigger repayments now while you can, as this will build a buffer for the day when higher home loan rates become a reality, but in the meantime helps you pay your mortgage off faster and therefore cut years off your mortgage and save you a heap of money too.

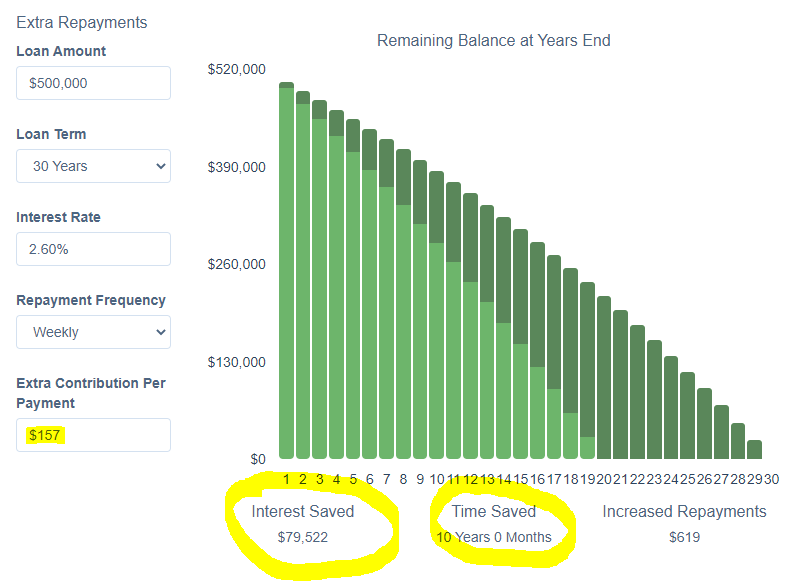

The graph below shows you the result of paying the extra $157 a week on the $500,000 mortgage.

The results will be a surprise to most people!

In this simple strategy you are paying the home loan as though the interest rates were already at 5.00% but while at the lower interest rate (average 2.60%) you are able to make significant extra payments which go straight off the loan balance and if this was sustained would cut 10-years off your mortgage term and save you almost $80,000.

You can test your own situation using our mortgage calculator here.

Getting The Right Loan Structure

The example above was to show you an example of how you should factor in the possibility of higher interest rates and the impact of adjusting to the higher repayments now. It is not recommended to just lump all of your mortgage at an “average” fixed term rate. I will leave that sort of average approach to the banks, and I will focus on loan structures that work best for you.

First, I need to understand why you might have the mortgage split into various different loans.

Here are some ideas to help with the basic loan options that most banks can offer;

Revolving Credit Loans – these are basically overdrafts that are attached to your home loan, and therefore are at lower rates than an overdraft but still the floating rates are higher than the fixed rates. They are very flexible and help you manage your repayments and pay your home loans off faster, but given the higher floating interest rates you want to limit the size (the credit limit) of a revolving credit facility. As an adviser, I do recommend that these form part of the loan structure in most cases and can provide advice on selecting the size of the facility to suit.

Short-Term Fixed Home Loans – I talk about the 1-year fixed and 2-year fixed home loans as being ‘short term’ and these are often have the lowest interest rates too. In most cases a good mortgage strategy would have some lending on both 1-year and 2-year fixed terms and then rotate on a 2-year roll-over which means every year you have a loan coming off fixed and being refixed for 2-years. This gives you an opportunity to adjust repayments each year and also making additional lump-sum repayments to help pay the mortgage off faster.

It also forces you to review your mortgage, and financial situation each year with the adviser which is a great habit to get into.

Longer-Term Fixed Home Loans – are the fixed terms from 3-years to 5-years. Often people do not use these when setting up their loan structures as they are generally higher interest rates compared to the shorter fixed term rates; however they do offer some longer term certainty which can be a good thing when there is talk of interest rates increasing and also for those people that have bigger mortgages. As a mortgage adviser, I will often suggest some of the mortgage is put onto these longer term fixed rates and especially for first home buyers who may have a larger mortgage and for property investors who want certainty to help them budget.

How Loan Structures Work With A Mortgage Strategy

Recently I set up a strategy for a couple and used the following loan structure;

| Revolving Credit / Floating / Interest Only | 4.05% | $20,000 |

| Fixed 1-Year | 2.25% | $140,000 |

| Fixed 2-Years | 2.45% | $140,000 |

| Fixed 3-Years | 2.75% | $100,000 |

| Fixed 5-Years | 3.25% | $100,000 |

This gave them the flexibility with the revolving credit account to manage the repayments and they can pay more off the mortgage this way too. They have the structure of the 1-year and 2-year fixed rates so they can pay a lump-sum each year and adjust the repayments to suit, plus they have some of the lending fixed for longer terms to offer certainty.

Overall with the fixed lending of $480,000 they are paying an average rate of 2.62%

This is obviously more than if they had of fixed the whole mortgage on a 1-year or 2-year fixed rate, but it gives more certainty for longer.

In this case, I also had refinanced the lending so they had more flexibility.

Do All Banks Offer The Same Options?

Most people think that all home loans are the same, and if you look at how they are advertised then it can appear that way; however there are some fundamental differences that can have a huge impact and should be considered when selecting a home loan.

In the case above, I refinanced this couple to Sovereign Home Loans which offered better options for them. Sovereign Home Loans is effectively a ASB Bank mortgage but as an adviser I believe it has some advantages that mean it is more suited to a strategy especially for younger people.

- One of the key features that both Sovereign Home Loans and ASB offer in their home loans is the ability to increase the repayments on a fixed home loan by up to $1,000 a month. In the case above this means they could increase the repayments if they wished by $4,000 a month ($48,000 per year) as they have four loans. Some other banks allow smaller increases but the reality is banks do not really want you to pay your loans off faster.

- Another key feature with Sovereign Home Loans is the underlying loan structure. With most home loans if you increase the repayments to try and pay your home loan off faster then you effectively shorten the loan term and that commits you to the shorter loan term and higher repayments for years. With prospects of higher interest rates or younger people who may want to start a family you do not want to shorten the loan term and be forced to pay higher repayments in the future. with Sovereign Home Loans you can increase your repayments for the period that you want, and when that loan comes off fixed you can lower the repayments again to the minimum if required.

Our recommendation was Sovereign Home Loans as it offered this couple the flexibility required.

It also gives them the confidence to focus on making higher repayments when they can, but knowing that they are not committing themselves to having higher repayments forever.

Let’s Review Your Mortgage With You

As a mortgage adviser I can work with you to design a strategy and review your loan structure.

It doesn’t matter if I have never spoken or if you are not in Auckland, as I am able to work with people from all over New Zealand and with most banks too.

The review costs you nothing and might help save you a lot of money over the coming years, but even if you are on the right track it gives you the confidence that you are.

The easiest way to arrange a review is to click here, and I’ll soon get in touch.