New Year’s resolutions are meant to make a positive difference to your life so when you consider your finances switching banks may be the best decision that you can make.

Switching banks may seem like a bit of trouble with paperwork to supply to your broker or bank, but if it helps you to pay your home loan off faster then it is worth it.

But do you have to switch banks if you just want to pay your mortgage off faster?

You may think that you can pay your mortgage off faster with your existing bank, and you can.

But some banks will offer you better options and more flexibility which allows you to do even better

So rather than being complacent why not have a look at all the options and ensure that you have the best mortgage.

You may be pleasantly surprised how much you can save!

Get Free Advice From a Mortgage Broker

People often ask what are the benefits of using mortgage brokers.

Some people may think that the role of a mortgage broker is just to source a home loan.

If that was all a mortgage broker does then you could just go straight to the bank.

But the role of a good mortgage broker, like myself is to source home loans, explain the options, set up the loan structures and of course review mortgages to see if there are ways to improve them.

Often when we review mortgages we will see things that could be done better.

This includes the way the loans are structured and the way they are managed.

You may want the flexibility of floating interest rate loans, but also want the certainty with fixed interest rate loans.

Before you commit to just any mortgage you should know what makes a good fixed loan.

What Makes A Good Fixed Home Loan

A lot of people we talk with have said that they thought that all home loans were the same.

After talking to them they realise that they are not quite the same – they thought they knew about loans and may have trusted their bank to advise them.

But banks cannot offer full advice?

The staff within a bank will be able to offer that nbanks products – the banks home loan options and bank accounts plus they try to sell add-on products like KiwiSaver and insurances too.

It is important to understand too that when banks design their home loan options they include things that they think people might want or at least include the features that are easy to “sell” however they tend not to focus on thinks that may allow you to pay off the home loan faster.

The banks are businesses designed to make their shareholders money so do you really think they want you to pay your mortgage off faster?

Banks are in business to make money, not save you money!

While the bank may want to make money from you (the customer) it is not your role to help the banks bottom line. You should be thinking what will be the best loan for you and your family and if that means switching banks then that is what you should do.

There are some key considerations when selecting a home loan;

You Want Competitive Interest Rates – everyone wants to know that they are getting competitive interest rates. As mortgage advisers we focus on ensuring that the rates are always “competitive” rather than the lowest advertised rates on any given day. Luckily in New Zealand the banking market is a competitive one and most banks will match the other banks rates so we are very successful in getting and continuing to get good interest rates.

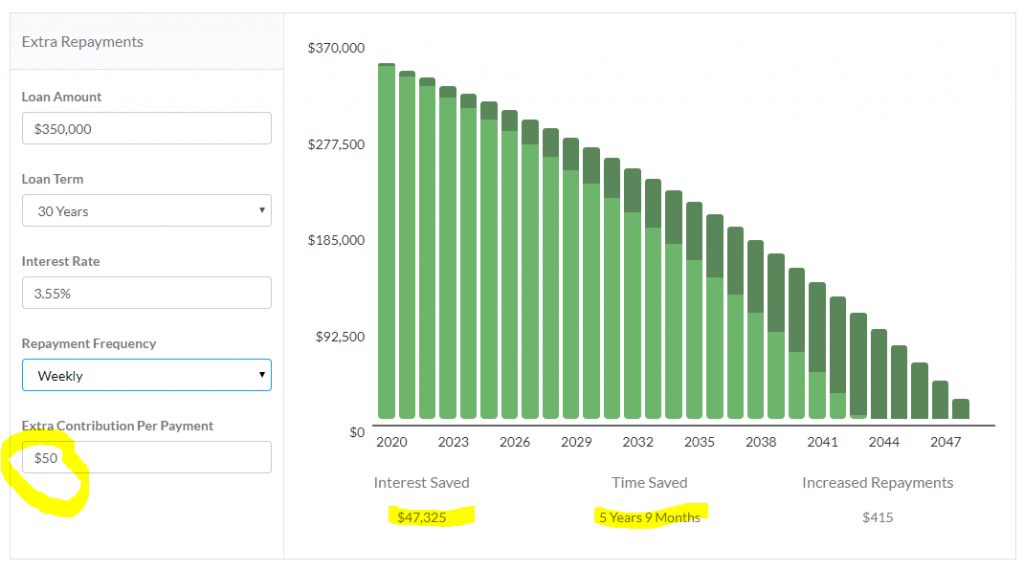

You Should Have The Ability to Increase Repayments – you can increase the repayments when you set up a loan, and a number of banks will allow you to increase the repayments during a fixed term. You can see in the table below which banks allow you to increase the repayments during a fixed term and the limitations for the specific banks.

And, The Ability to Decrease Repayments – it’s great to be able to increase your repayments within a fixed term as this is one of the best ways to pay your mortgage off faster; however sometimes circumstances change and you may need to lower your repayments again. Unfortunately only one bank gives you the ability to automatically do this without penalty.

Plus You Need The Ability to Pay Lump Sums – having the ability to pay lump sums on a fixed loan can be extremely useful and helps you pay your loans off a lot faster.

These are four of the main criteria for selecting a home loan if you are serious about paying it off faster.

Good Mortgage Managers Do The Research

As I have already mentioned the banks are not good at providing advice.

At best they will explain the features of the products which that specific bank has, and generally they will know little about the other banks products.

The banks generally tend to let you believe that all loans are the same and its the interest rates that are the key differentiation between the various loans.

As a mortgage adviser I know that you rely on the advice that I provide.

To enable me to provide the best advice it means I need to do constant research to ensure that I know what all the banks can offer.

I research the banks policy so I know which bank will approve your application, and I also research the various loans that the banks offer as I want to know which bank makes it easy to pay your home loan off quicker.

Over the long term this is what is going to make the most difference for you!

As a mortgage adviser I often asked “can I pay more off my mortgage faster?”

Your mortgage is probably going to be your biggest financial commitment (biggest debt) and while we know that the interest rates are important, it is the ability to pay your mortgage off faster that should be the main focus when selecting a loan.

It can make a HUGE difference and that is why some of the best mortgage brokers not only focus on sourcing home loans, but they also have strategies and ideas to help you pay them off.

It’s another reason to use a mortgage broker.

As illustrated here, a small extra repayment of $50 a week could save my client $47,325 and have her home loan paid off 5-years and 9-months earlier.

One Bank Has All The Features

You would think that the banks would make it easy to pay your home loan off faster, but they are in the business of lending money to you.

It is however good to see that one bank does have the four key features listed.

That bank is TSB Bank which is also a New Zealand owned bank.

You can read on their website more details on these options which include making additional payments, changing payments.

StepUp is another useful option they have which is an automatic feature of their loans that you can select to have. It increases your repayments a little each year to help you pay your mortgage off faster.

Is Switching Banks A Good New Years Resolution?

It makes sense to have your home loan with a bank that makes it easy for you to pay your home loan off quicker.

Of course, it may seem like a bit of a hassle to switch banks, but as a mortgage broker I can take care of this for you – I can make switching banks easy.

I have already told you which bank it is, and I know that you could go directly to the bank and arrange to switch; however there are more benefits in having me arrange this for you.

- As a mortgage broker I can get your home loan approved with TSB Bank and help structure your loans plus ensure that you get competitive home loan interest rates.

I would love to help you to review your mortgage and see if switching banks is going to help.

Get started now – we make switching banks easy … it is as simple as