The Kāinga Ora Shared Home Ownership Scheme

First Home Partner is a shared home ownership scheme administered by the Government Kāinga Ora (previously known as Housing New Zealand).

It’s an alternative way to help first home buyers to get into their own homes, especially those people (or families) that have lower deposits or lower incomes.

It’s For both Brand New & Existing Homes

This is a scheme to help first home buyers get into their first homes – for an existing home, the deferred maintenance repairs must not be over $5,000.

What Is Shared Home Ownership?

Shared home ownership is where you are the majority homeowner, but you initially share ownership of a home with a third party – in this case, with Kāinga Ora. Shared ownership schemes are usually designed to help those who have an insufficient deposit or cannot service a larger mortgage on their own.

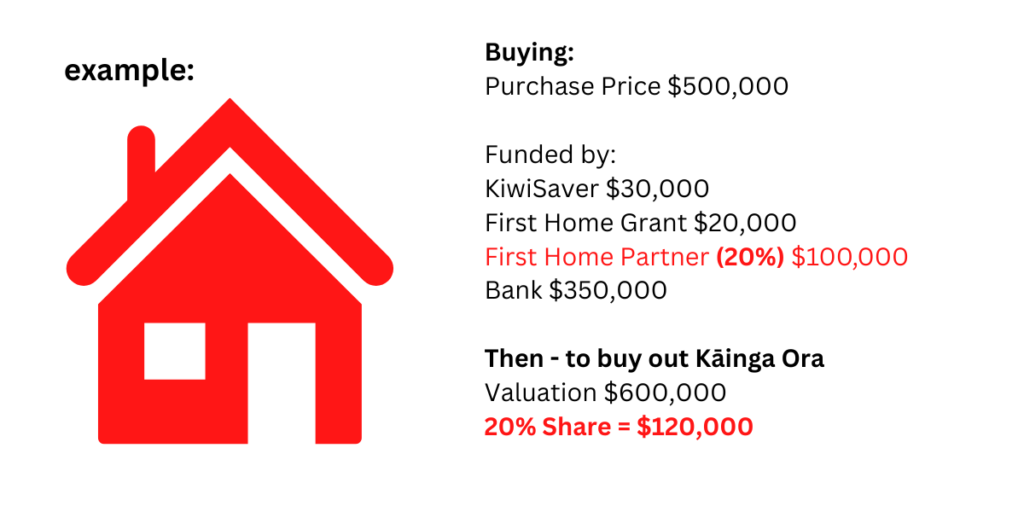

With First Home Partner, the home buyer (you) must provide a minimum deposit of 5% toward the purchase price of the home. Kāinga Ora then contributes an agreed amount in return for an equivalent share in ownership – up to 25% of the purchase price or $200,000 (whichever is lower).

The buyer then progressively purchases back the share of the home owned by Kāinga Ora at the current market value, increasing their share of ownership in the home.

The goal is to achieve full ownership within 15 years.

The Criteria For First Home Partner

When you want to take advantage of the First Home Partner shared home ownership scheme you still need to meet the lending criteria of the bank to receive a home loan, including providing the mortgage adviser all of the supporting information.

The First Home Partner shared home ownership scheme is designed specifically for first home buyers who may struggle to get a standard mortgage due to a combination of a lower than ideal deposit and possibly a lower income than the banks may require too, and therefore there is some specific eligibility criteria.

It is not designed to help people with bad credit. Your mortgage adviser will complete a credit check to ensure that you have a good credit score and nothing adverse.

You need to commit to living in the home as your primary place of residence for at least three years (from settlement) and to meet annually with a Kāinga Ora Relationship Manager to review the financial circumstances of your household. The idea is to work towards the goal of achieving full home ownership and you will need to do your best to purchase the share of the home owned by Kāinga Ora within the first 15 years of ownership, and must have purchased the share in full by the 25th anniversary from the date of settlement on the home.

When you use the shared home ownership (using First Home Partner) it won’t feel very different from full home ownership as you are the majority homeowner. Kāinga Ora are financially a partner but will not use or occupy your home.

Are You Eligible?

To be eligible for First Home Partner, you must:

- Be over 18 years old

- Be a New Zealand citizen, permanent resident, or resident visa holder who is ordinarily resident in New Zealand or be applying with someone who meets the citizenship or residency requirements, and you are married to or in a civil union or de facto partnership with that person

- Be a first home buyer or a previous homeowner in a similar financial position to a first home buyer

- All eligible applicants can purchase existing homes, in addition to new builds, through the scheme. This is intended to provide buyers with a greater choice of homes.

- Have a total household income of no more than $150,000 (before tax) from the last 12 months

- Higher income total cap for multi-generation application.

- Be in a financial position to contribute a minimum deposit of 5% towards the home purchase

- Be buying the home for you to live in and commit to living there as your primary place of residence for at least three years from your settlement date

- Have not previously received shared ownership support from Kāinga Ora

Buying The Kāinga Ora Share

It’s a great way to get into your own new home, especially if you do not have a high enough deposit and/or if you have a limited income.

Kāinga Ora can help by funding up to 25% of the purchase price or $200,000 (whichever is lower) and you pay no interest or repayments on this amount. It can be tempting to try and keep this for the full 15-years as it seems like a good deal; however if (when) the value of your home increases then so does the amount that you repay to Kāinga Ora.

In the example above, the value of the house increases by $100,000 and therefore if they hold an ownership of 20% then that increased value will cost you $20,000.

Kāinga Ora are offering the First Home Partner scheme to help you get into your home, but the concept is you will buy the Kāinga Ora share as soon as you are able to. The longer you leave it, the more likely that the house value will increase and in that case the more you will need to repay to buy the share owned by Kāinga Ora.

You will be encouraged at your annual review to pay off / reduce the shared ownership, but regardless this should be a focus anyway.

Let’s Get Started

If you want to buy your first home then you want to have experienced mortgage advisers to help you navigate the options and help prepare your applications.

While there is never a guarantee that you will be able to buy your first home now, our advisers can ensure that you have the best chance and get the best advice.

Our advisers can help you now, or to get prepared for home ownership in the future.

James Puah

James Puah